How to read

candle chart correctly

A popular question that many traders ask when looking at a candle chart is; What candlesticks work the best?

The answer is not that simple. There is no one or two candlestick patterns that can be used without looking at other factors on the chart.

The idea is to get a feel for the

psychology behind the price action first and then consider how the

candles can help to determine market direction.

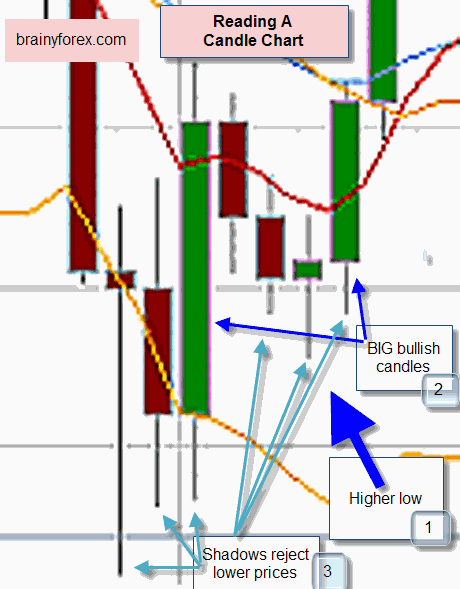

Take for example the candle chart show above. Lets read the chart based on the three items mentioned.

Number 1. Consider price pattern and time.

We

see that as time progresses a higher low is made. This is also known as

a pull back in price. Or we can even consider it as a second wave in

either a zig zag formation or a impulse wave. Which ever way we look at

it we know that it is a bullish sign indicating a high possibility of

prices moving higher.

We also notice that by counting the

number of red bearish candles as compared to the green bullish candles

that it has taken more time for the bears to prevail than the bulls. In

other words it does not take long for price to move back up once it is

pushed lower.

Number 2. Consider candlestick size.

Take

a look at the time frame we are considering on the chart and look at

how LARGE the green bullish candles are compared to the red down

candles. This shows that bulls are biding up the price and are keen to

buy. Price has a good chance of increasing, especially when increasing

volume is associated with these bullish sessions.

Number 3. Consider candle shadows.

As

shown on the chart we notice a lot of candlestick shadows, whereby

price has moved lower only to be pushed back up within that particular

time period. This shows that the buyers are keen to purchase when price

reaches a certain low level. Hungry buyers, without enough sellers means

that price will have a good chance of increasing yet further.

Summary

Points

one, two and three are the main essentials in reading a candle chart.

Once a trader understands these three points and applies this

understanding when reading charts it is all down hill from here. It is

now easy.

A trader does not need to know if the price pattern

falls into the definition of a morning star pattern, morning doji star

or abandoned baby. The trader knows straight away the significance of a

bearish candlestick, followed by a doji (open and close the same),

followed by a bullish candlestick. It means there could be a reversal

SUBJECT TO points 1, 2 and 3 discussed.

To continue reading about the underlying basics to candlestick patterns go here.