Forex Day Trading Advantages

Forex day trading has its advantages and disadvantages. Those day traders whom study intra-day charts with shorter periods of time have some advantages over traders whom only use end of day charts.

Some of the advantages of day trading forex can be summarized as follows;

- Can trade with closer stop losses, thereby limiting risk.

- Detection of reversal of trends earlier than end of day traders.

- Can profit from shorter term trends. (Seconds, minutes or hourly trends)

- Avoid overnight unexpected price movements, when unable to view the markets.

Disadvantages of forex day trading

- Involves more time commitment than end of day trading.

- More stressful. Refer trading psychology here.

The growing trend for day traders is to program their forex trading strategy into MetaTrader, thereby overcoming the inherent disadvantages of day trading. Learn more about automated forex trading here

Who makes the most money? Day traders or Position traders?

A

good question would have to be, do those whom practice forex day

trading make more money than the traders whom hold positions for at

least a few days?

I have not heard of any research that

answers that question. I would assume (overall) that end of day traders

whom hold positions for between one to four days or longer would be able to make

more that a day trader entering and exiting positions all day long. (Some well known successful day traders are also known to hold positions open for a month or more at a time, looking to capitalize on the longer term cycle).

Why

could it be assumed that position traders would make more money than day traders? Overall, because of the physical and

mental demands / challenges / stress of day trading, which most people would not be able to cope with day in day out. The forex market can oscillate up and

down wildly at times thereby putting enormous pressure on day

traders trying to perform consistently.

With

the increase of automated trading robots, this will no doubt change? What WD Gann calls the weakest element in trading, "the human element"

has now been overcome.

The most profitable traders into the future are probably going to be those that use a

combination of end of day strategies with their automated robots. That is

these 'end of day traders' whom in the past have traded time frames of

one to four days will now build simple MT4 programs to only trade the

anticipated direction of their one to four day forecast.

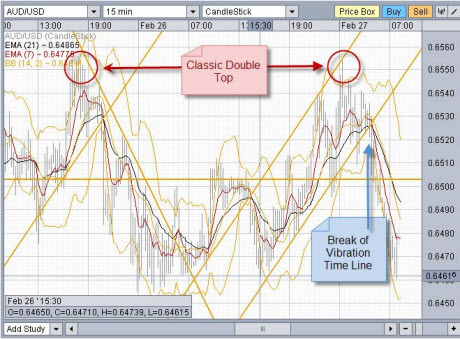

Example of intra day chart

The example below

is a 15 minute candle chart which shows a vast array of information that

those forex day trading can take advantage of before the end of day data is available.

Longer term position traders can also benefit from reading intra day price action. Even though they may not actively 'day trade'.

The next example shows the same chart on a 1 hour basis

How Do You Feel About This Topic?

What are your thoughts about this? Share it!

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

Intraday vs Longer Term vs Scalping Not rated yet

Tell me, who do YOU think would be the most successful?

… a Long Term Trader, an Intra-day Trader or a Scalper?

Well the answer to that is all, …

Return Home from Forex Day Trading

New! Comments

Have your say about what you just read! Leave me a comment in the box below.