Forex Tip Trading Secret

Compliments of WD Gann

This is a forex tip trading secret that relatives found after WD Gann's passing. He left in his trading room a square of nine chart whereby he would locate support and resistance levels for trading the stock market and commodity market.

For those unfamiliar with the square of nine chart it is a chart with

numbers starting with number one in the center, number two on the left,

number three on top of number two, number four on the right of number

three, number five on the right of number four, number six below number

five, number seven under number six, number eight to the left of number

eight and finally number nine to the left of number eight. These numbers

in a square (1-9) are what is know as the foundation of the square of

nine. All other numbers keep being added around this initial square in

similar sequence as the first nine. Once the numbers are built up

natural support and resistance levels show for any mathematical formula.

It is just a matter of reading the chart horizontally, vertically or

diagonally.

WD Gann was not the inventor or founder of this

system. He obtained it from the Middle Eastern Culture and Ancient

Indians. However, he has been credited as being the first to master and

use the numbers with his trading. These powerful number sequences are

said to work on a universal basis, in the structure of maths.

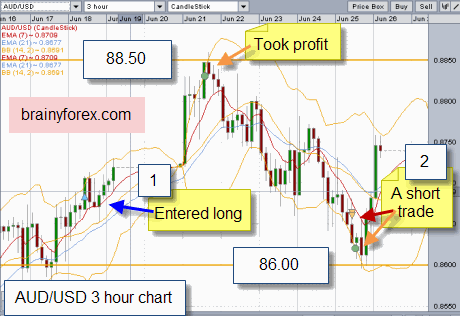

Enough of the background, lets look at last weeks (June 2010) day trading results in the AUD/USD.

On the chart below we see how price action held between 86c and 88.5c. [The natural square levels]. When I placed these two trades I anticipated price to have a difficult time passing these levels.

When Gann day traded he had expectations of where price action would

stop. It is believed he relied heavily on his square of nine chart

showing these natural square numbers.

Last week when I day

traded the Australian dollar, I anticipated these natural square numbers

and nailed the market. (Credit to William Gann). The above chart shows

the two trades where the circles show where profit targets were placed.

20 pips under the natural square level for the first trade (long trade)

and 20 pips above the natural square level on the second trade (short

trade).

If you would like to explore these natural square levels further if you day trade the Australian dollar, they are as follows;

96c, 93.5, 91c, 88.5c, 86c, 83.5c, 81c

Notice

that 96, 91, 86 and 81 are the horizontal and vertical levels on the

square of nine chart, whereby a 50% division works well for 93.5, 88.5,

83.5.

For traders trading shorter time frames, further 50% divisions can be made yet further.

For more forex tip trading suggestions go here.

Return home from forex tip trading

New! Comments

Have your say about what you just read! Leave me a comment in the box below.