Share Your Forex Tips ... We Listen!

Below you will find a compilation of forex tips that will assist you to become a better forex trader.

It is important to realize that these tips will put the balance

of probabilities in your favor when trading forex markets. They are not

guaranteed to work all the time. Nothing will work all the time as the

forex market can move unpredictably when unexpected world events arise.

You are encouraged to do your own research on these forex tips

before you apply any of them for your own trading strategy or forecasts.

You are also welcome to share your forex trading tips with brainyforex readers. Add it on the page below, its easy to do.

PS - You can also provide a rating for these tips so that the best ones get shown first on the list.

Forex Tip number one

1."Serve your apprenticeship first by starting small"

Step one

Sign up for a Demo account and trade with play money before you risk your hard earned dollars. You will make mistakes when you are learning a new strategy or learning to trade. Several brokers let you have free never expiring demo accounts. Best accounts are DMA (Direct Market Access) ECN. Using brokers that are not Market Makers is a wise choice because they that don't profit from your losing trades.

Step two

After you have a proven track record of consistent profitability and you feel comfortable trading you can now move to a real account with a SMALL BALANCE.

The idea now is to prove to yourself that you can make money trading a real account with a small balance.

The reason for this is that many people react differently mentally when they trade a real money account as compared to a demo account. When they switch to a real money account they don't know why they fail after they successfully traded a demo account. The reason being that they are psychologically affected when they use real money. Fear of losing real money becomes a reality or fear of losing a good profit. Which in effect means they will fail to follow their system because fear and greed take over their decision making process.

If you can turn $100 into $200 by systematic trading using correct money management you will be able to turn $1,000 into $2,000 and $10,000 into $20,000. The same mathematical principles

apply. To trade such small amounts you will have to select a broker that allows extremely small trade lot sizes. Micro accounts are recommended for beginners. Each pip has a value of 0.10 instead of $10.00 for a standard account or $1.00 dollar for a Mini account.

Forex Tip number two

2."Check higher time frames for trend direction"

Currencies trend for long periods of time.

Check the yearly chart, quarterly, monthly, weekly and daily charts. We need to do this even if we are experienced traders and we place positions against the main trend. Why? Because a price move against the main trend will be subject to a quicker change back to the main trend. We can stay longer in a position that is going in the direction of the main trend. Trading against the main trend is considered a lot riskier than with the trend.

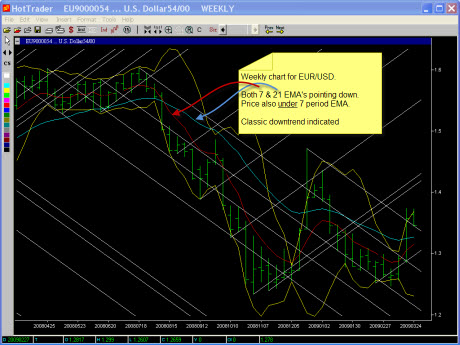

The chart below, Weekly EUR/USD shows how we could easily identify the trending direction by looking at the direction of the 7 & 21 period exponential moving averages. Both moving averages were pointing downward for a long time. Also, notice price under the 7 period EMA when in a fast downtrend.

(click on chart to enlarge in new window)

Forex Tip number three

3."Check for price levels exceeding prior time frames"

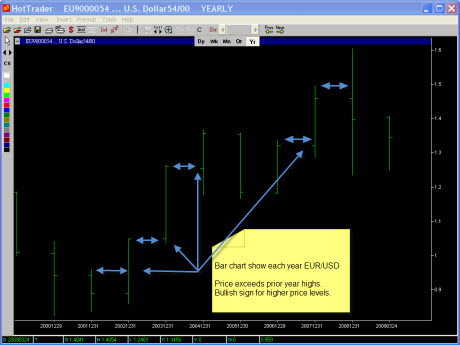

We want to check the price level to see if it has exceeded or fallen below certain time frames. When price levels exceed or fall under these prior levels there is good probability that they will continue in that direction for a little longer than the other direction.

When price exceeds prior year high this is a bullish sign, prices will probably continue higher. When price fall below prior year low this is a bearish sign, price will probably continue lower.

The same principle applies for the following time frames;

Quarterly high and low

Monthly high and low

weekly high and low

Daily high and low

4hr high and low

1hr high and low

etc

The higher the time frame the more powerful this works.

The yearly chart below, EUR/USD shows when price has exceeded the prior year highs it has been a bullish sign for higher price levels.

(Click on chart to enlarge in new window)

Forex Tip number four

4."Eyeball trend"

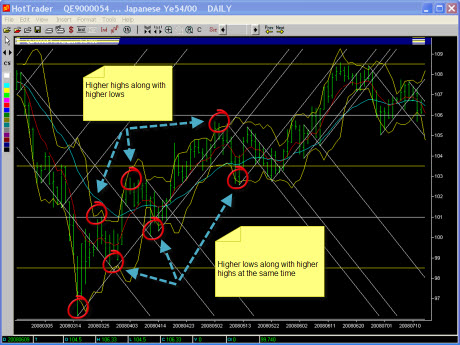

The foreign exchange market will not move in a straight line to its destination. Rather, it will move either higher or lower by means of "WAVES". When this is pointed out to you for the first time your brain will register the concept and you will see these waves from this point on.

The idea is to look for higher highs along with higher lows as the market moves upward. While the opposite is true for a downtrend; Look for lower highs and lower lows.

These waves are seen on every time frame.

The Chart below is USD/JPY daily. Notice higher highs along with higher lows.

(Click to enlarge - opens new window)

Forex Tip number five

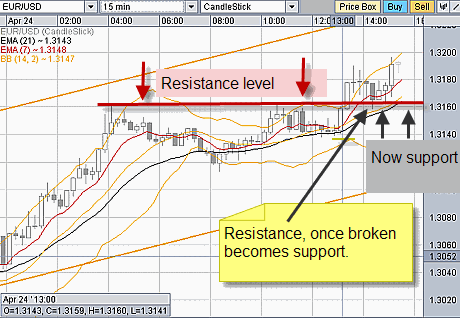

5."Old resistance becomes support" and "Old support becomes resistance"

WD Gann identified that once price broke through resistance, in many cases this old resistance level would act as support for price. The same principle holds true for when price falls below an established support level, it would mean that this area now has a high probability of acting as resistance and price will have some difficulty moving back through that level.

(Click to enlarge - opens new window)

Forex Tip number six

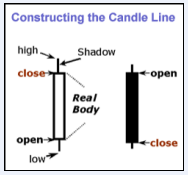

6."Learn to read candle charts correctly"

Candle charts not only show the trend of the move, as does a bar chart, but, candle charts also show the force underpinning the move. In addition, many of the candle signals are given in a few sessions, rather than the weeks often needed for a bar chart signal. Thus, candle charts will help you enter and exit the market with better timing.

Continue reading more about candlestick patterns on brainyforex

here.

Forex Tip number seven

7."Learn the secrets of natural square numbers"

One of WD Gann's greatest trading discoveries was the natural square levels for support and resistance. He used it for the stock and commodity markets. It works equally as well for the forex currency markets. Learn more about this powerful trading secret

here.

Forex Tip number eight

8."Use trailing stops"

Trailing stops can offer a great way to capture consistent profits. Instead of watching profits retrace and turn into losses be sure to grab some profits or at least breakeven. Read more about software that provides eleven ways to set a trailing stop here.

Know A Great Forex Trading Tip?

Do you know of a great forex trading tip? Share it!

Visitors Forex Tips Displayed By Ratings Order

Click below to see forex trading tips from other visitors to this page...

Position sizing methods tip Not rated yet

Give no consideration to position sizes, enter arbitrary orders with random sizing, and in the best case scenario your account will stagnate around the …

Forex Strength Trading Not rated yet

If you're a trader, I'm sure you're familiar with fundamental trading, technical trading, trend trading, candlestick trading, swing trading and all the …