- Home

- Gann Trading

- Gann mechanical swing trade strategy

Gann mechanical swing trade strategy

by Fritz

(brainyforex.com)

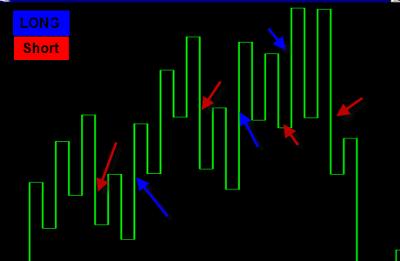

Gann swing chart with entries and exits

One of WD Gann's trading methods was that of the mechanical swing trade method. He would not use any discretion as to when to enter or exit the trade. His only indicator was the swing trade rules.

He would enter a long position when the previous swing high was exceeded to the upside. The position would remain open until the previous swing low was broken to the downside. At that time a short position would be entered. (ie Exit the long position and enter a short position).

This method would keep WD Gann in the market all the time.

The same rules apply in reverse when taking a short position. ie Enter a short position when a swing low is broken to the downside. Then exit only when when a swing high is exceeded. Then enter a long position as an entry is signaled on the exceeding of the prior swing high.

The chart shows blue arrows to enter long and exit short positions. While the red arrows show the place to exit long positions and enter short positions.

William Gann's idea was to profit from the big, long market moves. His winning positions would be a lot larger than his losing positions.

Read more about the strategy at brainyforex. click here.