- Home

- Forex Articles

- Interviews with Traders

- Gold Trader Interview

Gold Trader Interview

How Brian Keeps Doubling His Account

In this gold trader interview (15 July 2020) I interview a full time professional trader called Brian whom we have already done an interview in the past while he was trading a combination of currencies as well as gold. You can read that interview here. Brian has now turned his attention to exclusively trading gold, using a real money account. Since he has continued to do extremely well I reached out to him for a second interview to try and learn a bit more about his gold trading strategy. Hope you as the reader will benefit from some of the specific questions I have asked him.

Update : Soon after completing this interview with Brian, Brian's trading account has declined dramatically. Not sure if there is a logical reason behind this? If his trading methodology is flawed or if he has had a personal crisis or sickness in his life? I notice from his trading results he took a break from trading the markets for several months and he is still trying to trade his way back to success - So let's hope he can make a recovery to become the successful trader he was in former times. Best wishes for your recovery Brian! The link to view his current trading results is on the bottom of this page.

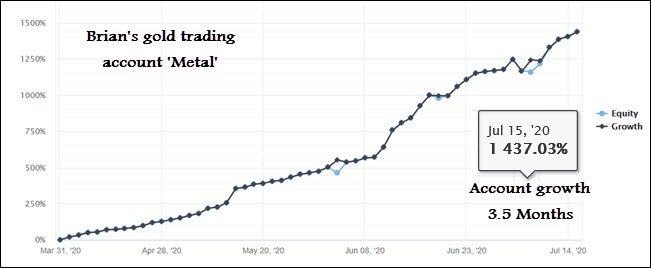

Brian's real money gold trading account showing incredible growth from $2,000.00 to $31,228.35 within 3.5 months.

Brian's real money gold trading account showing incredible growth from $2,000.00 to $31,228.35 within 3.5 months.Brainyforex : Do you have any long term objectives in mind for your Metal account? Since you started the account in April 2020 you made 151% for that month, May 124% and June 131%. How long do you anticipate you can continue to make such large gains? Surely, this doubling of your account cannot continue for much longer? If mainstream professional trading firms or the guru traders heard you were continually doubling you account each month they would not believe it or they would say that the account would blow up soon?

My only long term objective is to try to replicate Transparent. I never try to choose or predetermine a monthly gain. I work for positive results and any gain percentage is satisfactory for me.

Brainyforex : Readers can learn more about Brian's older trading account called Transparent whereby he turned $3,000 into multiple millions using a demo account in the first interview here.

Brainyforex : Can you please give us a run down of how you normally approach a typical trading day? ie Do you have a normal start time for your trading or have you got a trading indicator software which alerts you when a trade setup is approaching and then you need to move to your trading desk?

I typically trade during the U.S./London overlap. Trades happen any time of day, but the main times are during the overlap period. All trading is manual – no software is used.

Brainyforex : Can you also please provide a general overview on how you trade? Also, when it comes time to place an order which chart time frame do you consider before opening the position? Do you also consider the larger time frames on a chart, like the monthly, weekly or daily price action? Do you consider support and resistance on these larger time frames or some other indicator?

Most of the work I do is outside of actual trades. I study live news, economic forecasts, and gold forecasts which include previous days/weeks, current day, and days ahead. I primarily use the H1 (hourly) and M1 (minute) charts. I often use D1 (day) and W1 (week) as references. Support and resistance are always considered in my preparation. No other indicators are used.

Brainyforex : Do you normally open and close one position at a time? Or do you scale slowly into multiple positions depending on where the market has moved after opening your first position?

Normally, one position is the ideal. Yes, I will use more positions depending on where the market has moved. I always feel confident about the direction of the first trade, so if more positions are needed I am content.

Brainyforex : Do you have a maximum risk allowance / stop loss whereby you close all open positions if market conditions move against your multiple open positions?

Before each trade is open there is a plan in place when trades go against me. As I mentioned, one position is the ideal, but if the direction goes against me, I have a process to continually buy or sell as needed to pad the account and protect equity. If the trades went dramatically against me, I would close them and take an overall small account loss. I never trade with an all-or-nothing approach. This would certainly lead to an account failure at some point because no trader can win every time. I do not trade with a maximum risk allowance approach because sometimes it takes time for the direction to come back where I believed it would end up. If I closed trades based on a maximum risk theory, the account would be much different than it is today (not for the better).

Brainyforex : Further to that, if you believe strongly that price is going to move upwards in a bullish fashion and it is currently heading downwards in in a bearish way and you have several long positions going against you, would you open 'short positions' as a part of your strategy so as to try and minimize risk? or would you just continue to stick to opening more long positions at lower prices?

I never have conflicting trades going in both directions. Before I open a trade I am confident of my decision. I stay with my plan until the end.

Brainyforex : What advise would you like to share to help other traders to improve their trading results? And particularly when they are trading Gold.

Do research – extensive research. Studying everything possible (without too much) will greatly increase your chances of winning trades. Do not read two sites for a forecast and trade. That is not enough. After you read five or six forecasts, the economic calendar, and economic releases for the week ahead, you get a nice feel for what is ahead.

Brainyforex : I also notice that you offer people the opportunity to subscribe to your trading signals called 'Metal' through the platform SignalStart.com so as to have the exact trades executed in their accounts. What would you like to say to those people thinking about giving you a try? What account size minimum would you recommend they use and what percentage draw-down should they be mentally prepared to endure without panicking and starting to doubt in your ability to recover from the draw-down?

I do not want to lose my account, so I hope this gives potential subscribers the confidence to know I am serious about preparation and account longevity. I am sorry but cannot offer any advice on minimum size and percentage risk level. There are so many people and everyone has a different tolerance for risk. With forex, one must be prepared for any drawdown. Forex is risky and there are no guarantees of account success. I do not say this to put fear in anyone. I speak the truth. Some people draw others in by promising great riches. I do not promise great riches, but I do promise that I work now and in the future diligently with care. Thank you; I am grateful.

Brainyforex : Thanks so much for participating in this interview and sharing your candid answers. I, as well as others I am sure will continue to watch your progress with keen interest. Best wishes for your future trading.

To keep an eye on Brian's progress check out his trading statistics for his real money gold trading account at Signal Start called "Metal". The link is no longer available

NB : Brainyforex does NOT receive any compensation from Brian for this article nor any other affiliation.

Share your thoughts

Have you got any comments to share about the things mentioned in this interview?