Gann a big believer in market cycles

In WD Gann's writings on market behavior he said that markets continue to repeat themselves over and over again.

He said that this 'cycle pattern' was in line with the laws of nature whereby most things have a cycle or pattern.

These cycles occur on large time frame such as the ninety or sixty year cycle down to yearly or hourly time frames.

He mentions for example to be observant to the last digit of the

year. For example the year ending with "9" would indicate a bullish year

whereby stocks would move upwards during those time periods. So looking

far into the future 2019 has a high probability of being a 'bullish

year'.

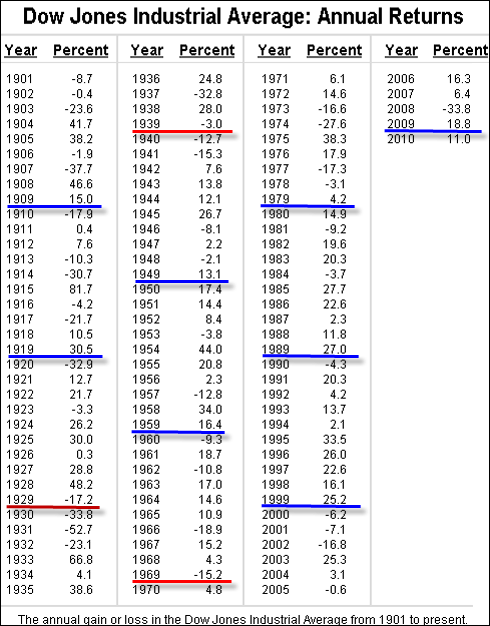

Back testing WD Gann's theory on market cycles is very easy as we

can see that the past ten year cycles have played out as follows since

1909;

2009 bullish

1999 bullish

1989 bullish

1979 bullish

1969 bearish

1959 bullish

1949 bullish

1939 bearish

1929 bearish

1919 bullish

1909 bullish

This shows a accuracy of of 73%. (8 bullish years out of 11).

[Check out the table below]

For readers interested in exploring this method of forecasting to

improve their market analysis technique a software program has been

developed which enables users to quickly filter this type of

information. For further information visit

www.trademiner.com.

Or find out a little more about this software here at brainyforex by clicking

here.

Read more about WD Gann's background here.

Data for this chart was kindly provided by Forecastchart.com