- Home

- Forex Articles

- Stop Loss Order

Why use a stop loss order?

Some professional traders say that using a stop loss order when trading is not a good idea for the following two reasons; 1) Unfavorable price spikes causing your position to be exited early when price temporarily reverses only to resume in your favor again. You are left feeling frustrated in addition to accepting a loss that you did not deserve based on your analysis. And 2) Claims of stop hunting by some unethical brokers.

Other professional traders say EXACTLY the opposite. They strongly recommend to ALWAYS USE STOP LOSS ORDERS!

I believe the answer is to follow the safest path. Reduce your risk at all costs. Consider some of these thoughts;

* Use a broker that is unbiased. That is a broker that does not use a dealing desk. ECN or STP brokers are best. This way the conflict of interest is reduced as the broker does not take the opposite side of the trade. Read more about forex brokers.

* Design your trading system so that your placement of stop orders are not prone to early activation. This can be done by placing them under say a prior swing low. Or not making the stop loss too tight so that market noise triggers it. If you are going to use a tight stop loss then it may prove beneficial to use a tight profit target. Read more about the maths behind designing a good trading system here.

* Using options as a hedge to reduce risk instead of using stop loss orders is a feasible alternative. Or simply trade options as a full alternative to trading the 'normal' contracts forex market. Read more about forex options.

* Consider the effect on your trading account that ONE bad trade.

That one trade that just keeps on moving against you. These type of

trades do occur from time to time. Some trends just keep on going. Can

you afford that ONE BIG BAD position?

Is it not better to take a few extra small losses than suffer that big

bad trade? Consider the activation of these stops as a cost of trading

the markets. Mentally 'get over' some of these early activated stop loss

orders. Move on with your trading!

* Remember there is no such thing as the holy grain in trading. Losses will and do occur with EVERY system. Fact of life. Even the world's best traders have to take losses. WD Gann was regarded as one of the best traders ever and his success rate was about 93%. Read more about him here.

* Remember market manipulation does exist. Even in the foreign currency market involving huge cash-flows of funds daily, governments do sometimes intervene with their dirty floats. Read the article here.

Also, read about the Swiss National Banks surprise announcement on the 15 January 2015 here.

[What Does Dirty Float Mean? Known as a system of floating exchange rates in which the government or the country's central bank occasionally intervenes to change the direction of the value of the country's currency. In most instances, the intervention aspect of a dirty float system is meant to act as a buffer against an external economic shock before its effects become truly disruptive to the domestic economy. Also known as a "managed float".]

|

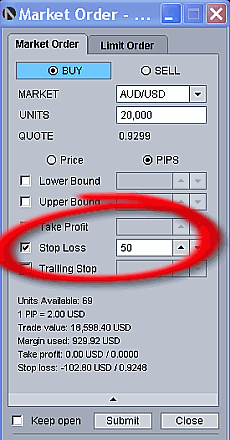

Stop Loss Order Stop loss orders can be placed at the same time as entering the

original position or any time after. The OANDA order panel shown on the left allows for

the placing the order at either a predetermined price or x number of

pips. Notice also underneath, the software also calculates the

anticipated dollar amount of the loss should it be activated. The

example shows that for a buy order of 20,000 units in the AUD/USD with a

stop loss of 50 pips, equals $102.80. Some trading software also allow for 'trailing stops' that automatically adjust when live market price moves. |

How Do You Feel About This Topic?

What are your thoughts about this? Share it!