- Home

- Ifc Markets

- Technical Analysis XAUUSD 29 September 2014

Technical Analysis XAUUSD 29 September 2014

As the US economy recovers and geopolitical tensions are easing, investors withdraw money from defensive assets such as gold and silver in order to invest them in the rising US stock markets. The quarterly GDP growth released on Friday last week turned out to be higher 0.2% than the previous value: 4.6% vs 4.2%. Certainly, we can consider this event as a positive sign of the US economy recovery which confirms the current trends on precious metals. Today we consider the long-term outlook for XAU/USD (Gold) instrument on the daily chart.

Let us analyze the daily chart of this instrument. At the moment the price is moving within the H4 and D1 downtrend channels. Bearish scale sync is being observed. ParabolicSAR and Donchian channel confirm the trend direction. There is only one contradiction on the part of the RSI-Bars oscillator, which crossed the resistance trend line and grew up to the green zone. For more confirmation in the investor mood, it is recommended to wait for the support breach of the indicator located at 17.86% (it is marked in red ellipse). The most significant gold movement is expected after the price drops below $1184.57 per troy ounce. This level coincides with the monthly (!) support. Definitely, the breach of this level will lead to the oscillator return into the boundaries of the trend channel.

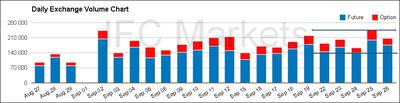

It should be noted that the volume of gold futures traded on the Chicago Mercantile Exchange stays within the corridor. The confident trend continuation can be observed when contract level outperforms the value of 235000. You can monitor the trading volume by clicking here. After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day. Thus, we are changing the probable profit/loss ratio to the breakeven point.

Position Sell

Sell stop below 1184.57

Stop loss above 1235.69

Daily Technical Analysis by IFC Markets

Return to IFC Markets Articles.